Congratulations!!!, it is a pleasure to inform you that you are in a new stage in your financing, in which you will be able to make use of your total awarded amount. At Hir Casa, we know that every step in this process is exciting, and we want you to enjoy it to the fullest.

For this reason, we offer you a detailed guide with the steps to follow so that you can complete your project of buying or building your property in a simple and uncomplicated way.

The key points to consider are:

– Cover your adjudication fee or complementary registration fee, we have two options, you can deduct it from your adjudicated amount, or you can pay it with your own resources.

– Be up to date in the payment of your monthly payments, for which we invite you to make your payments by direct debit, where in addition to not having to worry about making the payments, you will be able to obtain discount benefits in the administration costs of your fees.

– An important point is to maintain a good history in credit bureau having your other commitments paid up to date.

– You must prove your income which must be 3.5 times the amount of your monthly payment (the payment capacity will be measured, in case of not complying it will probably require a joint obligor or co-owner to back you up).

– Remember that the amount of your award is frozen, and your monthly payment continues to be updated until the settlement of your contract, according to the factor indicated in your contract.

– Your monthly payment includes life and unemployment insurance. At the moment of signing your deeds, the damage insurance is included, which covers any damage to the property.

– The property you want to buy must be urban, have all the services, be in a good state of conservation, having at least 30 years of remaining useful life. The value of the property must be equal or greater than the amount awarded. In case of acquiring land, it must be fenced.

– A bank appraisal of the property must be requested, this must be no more than 6 months old, the purpose must indicate that it is for mortgage loan guarantee or origination.

– The time to deed is 25 days, after the delivery of the complete documentation including appraisal, project of deed and certificate of freedom of encumbrance.

The documentation required to initiate the process will be the following:

HIR Casa Client – Natural Person

- Valid official identification (passport, voter’s card, or professional ID)

- Proof of tax status

- CURP

- Proof of address

- Birth certificate or current FM2 form

- Marriage certificate (if applicable). If you are married under the marital partnership regime, it will also be necessary to present your spouse’s identification, birth certificate and proof of tax status.

- Proof of income for the last 6 months, which will vary according to each activity (your advisor will indicate which documents apply to you).

Client HIR Casa – Legal Entity

- Articles of Incorporation and its updates

- Power of Attorney of the legal representative

- Audited financial statements and tax returns for the last fiscal year.

- Proof of income and general documents of the legal representative or main shareholder acting as joint obligor.

- Life insurance of the joint obligor

Selling party:

- Duly registered title deed.

- Property tax payment

- Proof of no water debts or if it is a new construction, feasibility of access to the service.

- Notice of completion of construction (when the property title only covers the land).

- Alignment

- Official number

- Contract of sale or promise of sale of the property you wish to acquire.

- In the case of condominium properties, a copy is required:

- Deed of incorporation of the condominium property

- Regime and condominium regulations.

If you have a bridge loan, trust or mortgage, some of the following documents may be required if applicable.

- Deed of credit and/or trust

- Letter of instruction from the institution with which the bridge loan and/or trust is held.

In case the owner is a real estate development:

- Articles of Incorporation, with all its protocolizations

- Tax ID

- Bank statement cover page, showing the name of the owner, RFC, account number and interbank account number.

- Powers of attorney of the legal representatives, and a copy of them will also be required:

- Official identification

- Birth and marriage certificates (if applicable).

- Tax identification card

- CURP

In case the owner is an individual:

- Birth certificate

- Valid official identification (passport, voter’s credential, or professional license).

- Proof of tax situation

- CURP

- Marriage certificate (if applicable). If married under the marital partnership regime, it will also be necessary to present the identification, birth certificate and proof of tax status of your spouse.

- Account statement cover page, showing the name of the account holder, RFC, account number and interbank account number.

For construction or remodeling you must present the following:

- Property title duly registered in the name of the holder of the financing, important, said property must be free of encumbrances.

- Property tax paid up to date.

- Official number.

- General description of the work. This document must be signed by the owner of the financing and the person in charge of the work.

- Lump sum construction budget with progress times and construction specifications. This document must be signed by the owner of the financing and the person in charge of the work.

- Pro-forma flow statement (format provided by HIR Casa).

- Construction and land use license in force.

- The installments will be delivered according to the construction schedule and progress of the work, including receipts that support the amount invested in the work, as well as photographs of its progress.

- The work must be completely finished in order to deliver the last installment.

- Restrictions apply.

HIR Casa has advisors who will accompany you throughout the entire process, to provide you with the proper guidance.

In short, we are here to help you every step of the way and make sure you have everything you need to complete your homeownership project.

We’re excited to be a part of this exciting journey with you!

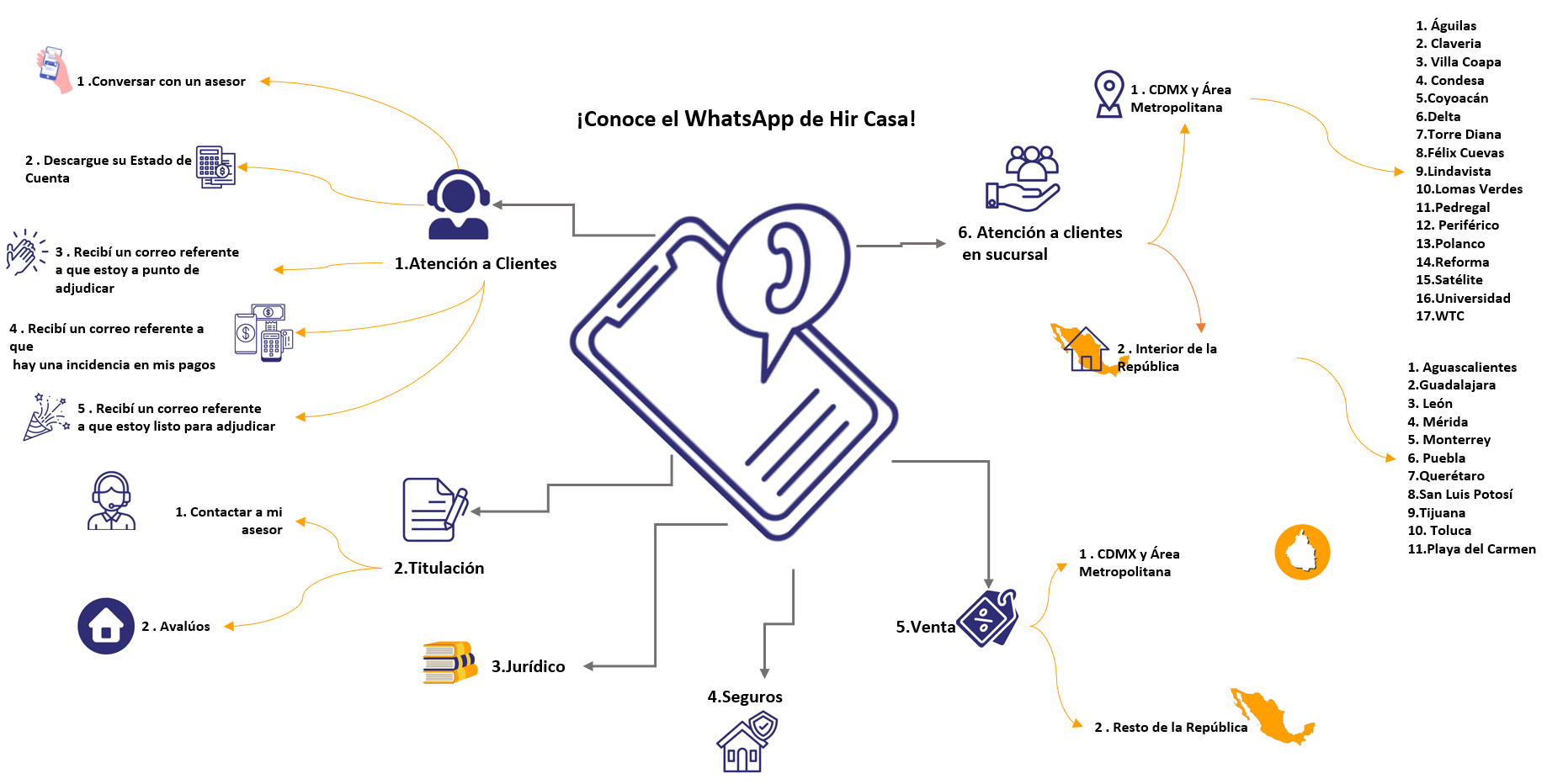

We are here to serve you, contact us:

Call 55 5511 9910 or 800 HIRCasa (4472272)option 2

Contact via WhatsApp at 55 7665 9885, click here

Send an email to atencionaclientes@hircasa.com.mx*

Enter the site http://www.hircasa.com.mx to contact us through chat

Deja una respuesta